Property Taxes

Taxes

Please note that tax rates are approved by Council about the end of May each year and the current year's tax rates are posted at that time. Before this time, for estimate purposes, you may use the previous year's tax rates.

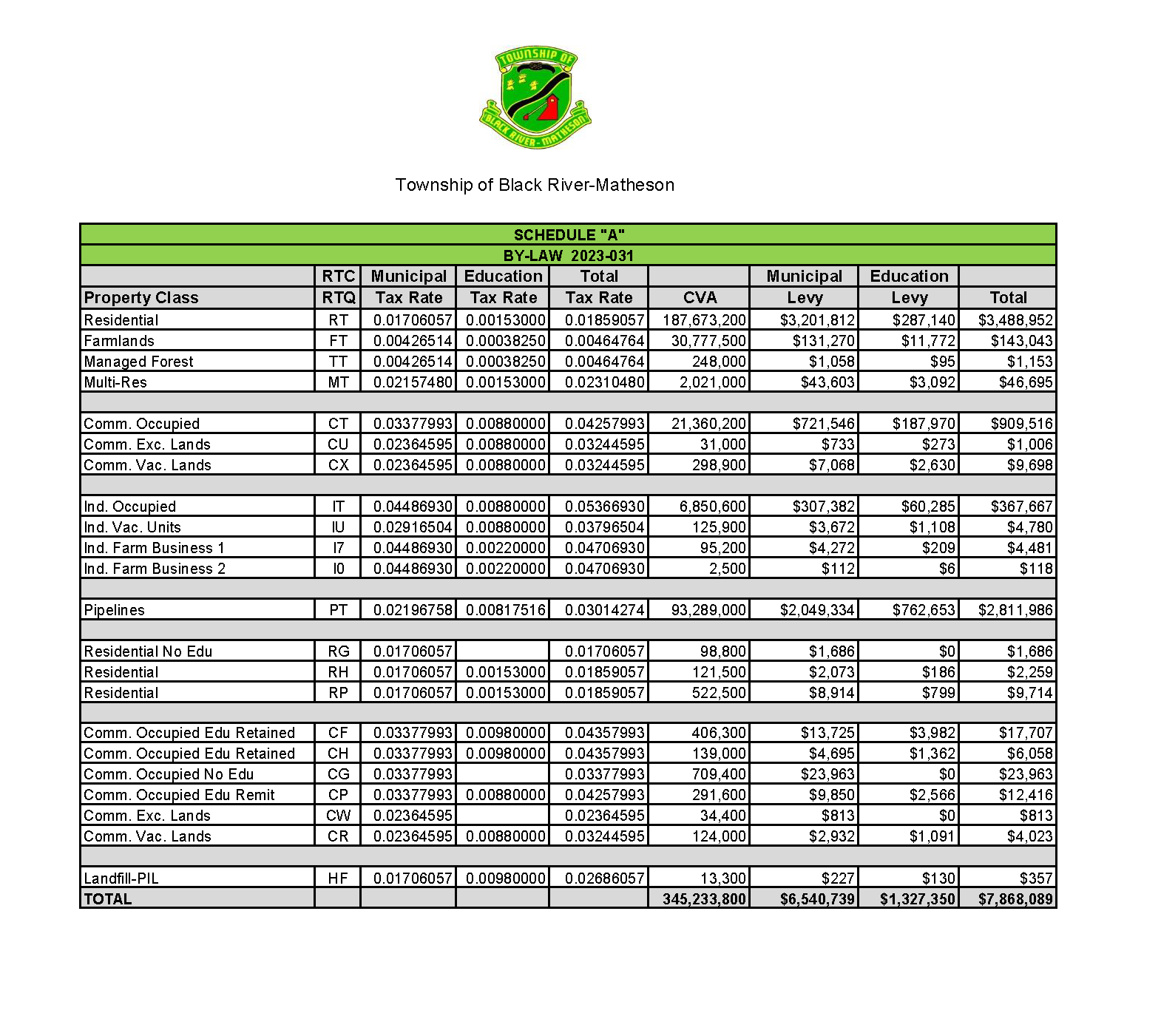

2023 Tax Table

Paying your Taxes

Interim Tax Bill

The Township of Black River-Matheson mails the tax bills by early February and there is 2 installments. Payments are due at the end of February and April.

Final Tax Bill

The final tax bill is mailed by early June and there is 2 installments. Payments are due at the end of June and August. (This bill reflects increases/decreases due to the setting of current year tax rates.)

Payment Options

BILL PAYMENT OPTIONS & INSTRUCTIONS click here

Township of Black River-Matheson, 429 Park Lane, P.O. Box 601, P0K 1N0

Cheques made payable to the Township of Black River-Matheson can be dated current or post-dated to the corresponding due dates

In Person

Town hall cashier services, 8:30 a.m-12:00 p.m and 1:00 p.m -4:30 p.m. Monday to Friday. Payments can be made by cheque, cash or debit.

After-Hours Drop Box

After hours drop box is located at Town Hall - 367 Fourth Ave.

Online/Internet Banking

Property taxes can be paid through your online banking by adding Black River, as a payee. The account number is a T plus your 19 digit roll number. Please note that for any electronic payment, credit will be given on the day funds are received in the Township of Black River-Matheson's bank account.

Financial Institution

Present your tax bill at any bank/financial institution across Ontario to make a payment.

Late Payment

Please note that in the event you are late paying your account, penalty/interest charges are added at a rate of 1.25% on the first day of default and the first day of each month thereafter if unpaid. (Payments on accounts are applied first toward the outstanding interest and penalty, then to the oldest outstanding taxes.)

Sale of Property for Non-Payment of Taxes

If property taxes remain unpaid for 3 years, the Town is authorized, under the Municipal Act, to sell vacant or improved land in any property class.

Once a certificate has been registered, partial payments cannot be accepted. A Tax Arrears Certificate indicates that the property will be sold if all taxes, penalties, interest and costs incurred by the Town are not paid within one year of registration of the certificate. This amount is referred to as the cancellation price.

For information on due dates and tax rates, the Black River-Matheson tax collector is Cassandra Child (Clerk/Treasurer) who can be reached at (705) 273-2313 Ext. 311

2012 Municipal Performance Measurement Programs

MPAC

Beginning this week, MPAC is mailing more than 38,000 Property Assessment Change Notice (PACN) to property owners across Ontario, representing more than $13 billion in new assessment for municipalities.

New Notice Insert

To help property owners better understand their notice and their updated assessed value, each PACN includes a new bilingual insert that explains:

- Why they received the notice

- How assessed value is different than market value

- Why the valuation date is fixed at January 1, 2016

VIDEO - How MPAC Assesses Property

VIDEO - How Your Property Tax is Calculated

VIDEO - Request for Reconsideration Process with MPAC

VIDEO - Welcome to "About My Property" MPAC

Update your mailing address online with MPAC

As a property owner, you will receive notices from the Municipal Property Assessment Corporation (MPAC) about your property's assessed value. If you own a property in The Township of Black River-Matheson but want to receive all your notices at a different mailing address, you can easily update your information with MPAC. Visit mpac.ca to change your mailing address online.

Contact Us

367 Fourth Ave.

P.O. Box 601

Matheson, ON P0K 1N0

Phone: (705) 273-2313

Fax: (705) 273-2140

Send an Email

Subscribe to Our News

Stay up to date on the Township's activities, events, programs and operations by subscribing to our News.